What are the best DeFi wallets to earn interest? This question has been the main issue addressed in this article. To answer this question, we have first to define the Defi wallets.

A “wallet” in the realm of cryptocurrencies is only a location where you may save your tokens.

There are many various sorts of wallets, but one of the most well-liked is a combination known as a Defi wallet. Decentralized Finance (Defi) tokens can only be stored in Defi wallets.

Defi wallets are straightforward and have several advantages over other wallets. The Defi network provides services and products, including lending and borrowing platforms, stablecoins, and tokenized BTC.

Here, we will examine the best Defi wallets to earn interest in more detail.

The best DeFi wallets to earn

The fact that you may earn interest on your digital token holdings, just as you would in a bank account, is a fact that many investors who are new to the cryptocurrency industry are unaware of.

Contrary to a typical bank account, you will have access to far more appealing yields. APY, a commonly used acronym for annual percentage yield, is the rate earned on an investment in a year, considering the effects of compounding interest.

The best Defi wallets to earn interest are as follows:

MetaMask

MetaMask is one of the best Defi wallets and cryptocurrency wallets currently available for Android and iOS, along with a web extension for Chrome and Firefox browsers.

MetaMask wallet can also be used as a Defi wallet due to its features, because it provides its users with easy access to connect to the Defi world.

Crypto.com

Crypto.com is the next option on our list of the top cryptocurrency interest wallets. This wallet provides many services, including free cryptocurrency exchanges where you may purchase cryptocurrencies, an NFT marketplace, etc.

Crypto.com offers interests of up to 14.5% annually. However, this tempting APY is subject to the length of your investment and staking CRO tokens, which are exclusive to the Crypto.com website.

Trust Wallet

With support for over 1 million distinct cryptocurrencies across blockchains and mobile device management, Trust Wallet is a versatile noncustodial cryptocurrency wallet.

Users of Trust Wallet may purchase Bitcoin using the app, send and receive money, and buy and sell NFTs. You can earn up to 11% APR since Trust Wallet does not take a cut of your earnings. Do you know about the Best crypto wallet for staking?

Crypto Defi wallet review

Customers may maintain financial independence by using a Defi wallet instead of relying on a third party. You have total control over your money and are free to do whatever you want with it.

The idea of being the sole owner of your currency is now revolutionary when you believe your bank has complete control over your money.

Nevertheless, DeFi users are not required to provide any necessary information or to validate their identities. DeFi wallets are popular because their privacy ensures that user’s personal information is never exposed.

The first area of contention in any discussion about decentralized financial wallets is the breakdown of the tools.

But you must know what you are searching for before looking for tools. Wallets are required to interact with the DeFi ecosystem since they provide valuable use cases and security.

While protecting your noncustodial DeFi assets is crucial, you must also provide a user-friendly interface. With DeFi wallets, you can keep your valuables secure even when they cannot connect to the internet.

Additionally, you will need web-based wallets that will make it simple to access DeFi protocols and allow you to trade cryptocurrencies flexibly.

The best crypto wallet that pays interest

Some of the Best Defi wallets to earn interest on your coins and tokens are listed as follows:

Atomic wallet

Atomic Wallet, a cryptocurrency wallet, supports more than 500 tokens and the most popular blockchains.

It was started by Konstantin Gladych in 2017 and had offices in Tallinn, Estonia.

There are versions for both mobile and desktop. Customers who stake their coins in this wallet can earn up to 16% APY.

Exodus wallet

A multi-asset desktop wallet called Exodus Wallet is also a mobile wallet. More than 100 currencies, including EOS, DAI, TRX, BTC, and others, are supported by it.

When users stake their coins in the wallet, they can earn interest.

Nexo

Nexo offers its clients high-interest rates on cryptocurrencies, stablecoins, and conventional currencies, including the US dollar, euro, and pound.

Cryptocurrency or stable coin storage on Nexo will return interest at 8% to 12% on those coins.

Nexo offers 12% interest on common currencies like the US dollar and the euro, far higher than a traditional bank would provide.

Binance

Depending on the investment period selected, Binance gives its clients a few various options to earn interest.

In addition to high-stakes DeFi staking, which provides the highest return rate at between 7% and 12.49%, depending on the currency, Binance also offers fixed and variable periods.

Binance users may earn anywhere from 1.20% APY on Bitcoin and 6.50% for 1 inch (1 inch) for the most secure, flexible term choice. How many crypto wallets are there in the world?

Top defi wallets

Decentralized finance (DeFi) has been gaining lots of interest within the crypto world, and with it, the want for steady and reliable wallets to shop DeFi property. DeFi wallets are important for handling various decentralized finance belongings, along with cryptocurrencies, tokens, and other virtual assets.

They offer users the ability to engage with DeFi protocols, lend, borrow, and trade property, all even as keeping manipulated over their budget.

Ledger Nano S

Ledger Nano S is a hardware pocket that provides a stable garage for DeFi belongings. It allows an extensive sort of cryptocurrencies and tokens, inclusive of those utilized in DeFi protocols.

The hardware wallet gives a further layer of safety using storing the man or woman’s non-public keys offline, making it less prone to hacking tries.

MyEtherWallet (MEW)

MyEtherWallet is a popular Ethereum pocket that also enables several DeFi tokens and houses. It is a web-based overall pocket that lets customers interplay with DeFi protocols and dApps right now from their web browser.

MyEtherWallet additionally gives customers full control over their keys, ensuring the protection of their virtual property.

Atomic Wallet

Atomic Wallet is a multi-foreign money pocket that supports a big range of cryptocurrencies, which includes those utilized in DeFi protocols. It offers a someone-nice interface and strong security features, making it a famous desire for managing DeFi belongings.

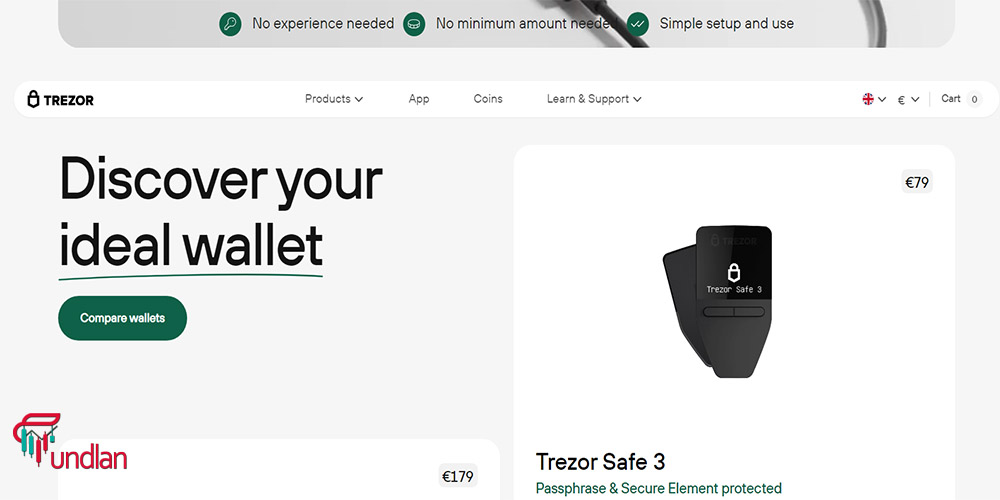

Trezor

Trezor is each hardware pocket that provides a constant garage for DeFi belongings. It supports an extensive variety of cryptocurrencies and tokens, permitting clients to save and manage their digital belongings securely.

Trezor additionally offers extra safety functions, which include passphrase safety and multi-signature assist.

Best Defi wallets to earn interest 2024

Decentralized finance (DeFi) allows market participants to execute services without a centralized intermediary, which has swept the cryptocurrency industry in recent years.

Within this expanding industry, DeFi wallets are a crucial device that enables investors to store their assets safely and with easy access.

This section covers the Best Defi wallets to earn interest, emphasizing what they are.

DeFi Swap

DeFi Swap is our top selection for the best DeFi wallet in 2022. Without a centralized intermediary, users may trade tokens and passively generate interest payments via DeFi Swap, a decentralized exchange (DEX).

The exchange does this with a convenient browser-based interface without needing any KYC verifications.

Crypto.com DeFi Wallet

Although DeFi Swap is one of our top and best DeFi wallets, the Crypto.com DeFi wallet is a fantastic alternative. As the name suggests, Crypto.com, one of the most significant cryptocurrency exchanges in terms of costs and asset variety, offers this wallet.

The non-custodial Crypto.com DeFi wallet may be downloaded free from Google Play or App Store.

Trust Wallet

Trust Wallet is one of the Best Defi wallets to earn interest available on the DeFi market. Over 25 million individuals use the mobile-based wallet Trust Wallet, which boasts compatibility with over 1 million cryptocurrency holdings.

Trust Wallet is one of the greatest DeFi wallets for asset selection since it supports 53 different blockchains.

MetaMask

MetaMask is a fantastic DeFi wallet to take into account for iOS and Android. Regular Bitcoin buyers are likely already familiar with MetaMask, which claims to have over 30 million monthly active users (MAU).

The wallet may be downloaded as a mobile app or a browser extension, fully supporting the Ethereum network.

Coinbase Wallet

The Coinbase Wallet is another Best Defi wallets to earn interest that provides features comparable to those of DeFi Swap and the CRO DeFi Wallet.

The Coinbase Wallet is the best option for beginners in the market because of its extraordinarily user-friendly layout and lack of complicated terminology or features.

This wallet may support more than 100,000 tokens, and it can also store NFTs.

Defi wallet interest rates

The interest charges offered by way of DeFi wallets are typically dynamic. They might range based totally on numerous factors, along with market situations, asset utilization quotes, and protocol-particular parameters.

Some DeFi protocols may additionally provide constant hobby charges, even as others may additionally have variable charges that change in real-time based totally on market demand and supply.

Several elements can have an impact on the hobby costs supplied via DeFi wallets. These factors encompass:

1. Market Conditions

Interest charges in DeFi are motivated by market situations, inclusive of the general call for borrowing and lending property within a particular protocol or platform.

When the call for borrowing is excessive and delivery is limited, interest prices generally tend to boom to incentivize greater users to provide liquidity.

2. Asset Utilization Rates

The utilization rate of belongings within a DeFi protocol can affect interest charges. Higher asset utilization prices may additionally result in increased demand for borrowing, which can result in better interest prices for lenders.

3. Protocol-Specific Parameters

Each DeFi protocol may also have specific parameters that govern interest fees. These parameters are typically set with the aid of the protocol’s developers and may encompass elements together with reserve ratios, collateral necessities, and risk management mechanisms.

4. Market Volatility

Volatility within the cryptocurrency marketplace can also impact interest prices in DeFi. During intervals of excessive volatility, hobby quotes may additionally differ more swiftly as market conditions exchange.

Defi Wallet Earn Rates

Beyond income interest via lending activities, DeFi wallets also provide opportunities for users to take part in liquidity mining and yield farming.

Liquidity mining entails providing liquidity to decentralized exchanges or liquidity pools in exchange for rewards in the shape of tokens or charges.

Yield farming, alternatively, includes leveraging exclusive DeFi protocols to maximize returns on deposited belongings. Platforms like Uniswap and SushiSwap offer opportunities for users to earn rewards with the aid of offering liquidity to their decentralized exchanges.

Similarly, protocols inclusive of Yearn Finance and Curve Finance allow customers to optimize their yield farming techniques by mechanically reallocating assets to the maximum worthwhile possibilities.

DeFi wallets offer several advantages, from excessive interest and earning prices

to superior security features. As the DeFi region continues to conform, these wallets are in all likelihood to provide even extra innovative features and opportunities for users.

Please note that investing in cryptocurrencies and DeFi involves risk, and you should only invest what you can afford to lose.

Is crypto DeFi wallet safe?

You may store your coins safely and have access to them anytime you need them with a DeFi wallet. Thanks to its security aspects, it is a secure option for keeping your digital cash.

Since it employs encryption technology to safeguard your funds, a DeFi wallet is secure.

It cannot be compromised or taken due to its encryption and storage on the blockchain.

To always have access to your money regardless of what occurs, it also enables you to back up your data.

You should always use proper security practices to safeguard your account, such as two-factor authentication and choosing strong passwords.

It is crucial to utilize Best Defi wallets to earn interest that encrypts your private data on your actual device—whether a desktop or a mobile one—so that only you can access it. (Best Avax wallet address list)

safest defi wallet

When it comes to choosing a DeFi pocket, security is of maximum importance. With the rise in hacks and safety breaches inside the cryptocurrency area, users need to prioritize safety when choosing a pocket.

Hardware wallets, including Ledger and Trezor, are often taken into consideration as the most secure options for storing virtual belongings as they keep private keys offline, presenting an additional layer of protection closer to online.

In the world of software program wallets, multi-signature wallets provide superior safety by requiring a couple of signatures to authorize transactions. Gnosis Safe, a splendid instance of a multi-signature wallet, lets customers set up custom protection rules and securely manage their virtual belongings.

Conclusion

One of the most crucial investment decisions you will make as a cryptocurrency investor is selecting which DeFi wallet you want to use to store your cryptocurrencies and to utilize for trading options, yield, and stake farming.

The closest thing you have to contain for your bank is a DeFi wallet. With Best Defi wallets to earn interest, consumers can access freedom, transparency, and control over their resources.

Users are finding it more and more challenging to choose the DeFi wallet that best suits them as a rising number of them are on the market.

Investors in cryptocurrencies must thus thoroughly consider all of their choices before making a decision.