We are with you once again with another interesting article about USDT TRC20 MetaMask. The information in this article will help you study and buy Tether on the TRC20 network.

TRC20 has defined certain standards and rules for decentralized applications, new tokens, and cryptocurrencies.

The most important features of this network are reducing the transaction cost, increasing the speed of exchange, and security.

Also, the TRC20 MetaMask network allows developers to create Tron smart contracts. Due to these features, this network is considered one of the best blockchain networks.

You need to know that USDT receiving addresses on different blockchains are different. Tether token receiving addresses on Ethereum or ERC20 blockchains start with 0X characters, and Tether receiving addresses on Tron blockchain or TRC20 start with the letters TR. Please be with us.

What is TRC20 MetaMask?

TRC20 MetaMask is a set of digital rules for the supply and management of tokens that are built on the Tron blockchain platform.

Of course, it should be noted that these rules only have the role of a general and mandatory rule for tokens, and any token can be present in the Tron network by adopting the general image of those rules.

The most famous example of these tokens, which was considered a lot when it came to the Tron blockchain, is Tether with the TRC20 standard, which was mostly traded on the Ethereum network before that.

Due to the congestion of the Ethereum network and its high fees, Tether Limited released its USDT tokens on the Tron network platform with the TRC20 MetaMask to reduce the cost of transferring and using this token.

The fundamental guidelines for producing new tokens and the platforms for trading and transferring them, including sending and receiving, are included in the TRC-20 token standard.

It should be noted that Tron digital currency (TRX), the network’s native token, is the most well-known cryptocurrency that adheres to this standard.

Providing they adhere to the TRC-20 smart contract standards, any currently active tokens on the Tron network can be swapped for other tokens and transferred.

These guidelines control several token structure features, including residuals, transfers, confirmations, supply, inventory, and supply.

In addition to the aforementioned, the TRC-20 standard allows for the following three more possibilities for tokens: Name, summary, and accuracy.

USDT TRC20 contract address MetaMask

To add USDT TRC20 MetaMask you will need the address of the token. The address is:TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t

You can go to explorer.bitquery.io to find more information about TRC20 MetaMask.

How to add TRC20 to MetaMask?

You should know that there is no direct addition of the TRC20 network to MetaMask; Because the Tron network is incompatible with MetaMask wallet.

Due to the incompatibility of MetaMask with EVM, you cannot add the ERC20 network to your wallet (convert ERC20 to bitcoin). Only blockchains compatible with the Ethereum Virtual Machine (EVM) can be added to MetaMask via RPC.

You can add the Binance-Pegged version of TRX to your MetaMask wallet through the Binance Smart chain network. TX is not native to Tron, but on Binance-Pegged it has the same value as the TRX token.

Binance Pegged currencies are 100% backed by the original coin and issued to addresses that can be audited.

Here’s how you can easily add Binance-Pegged TRX to your MetaMask wallet in just a few steps:

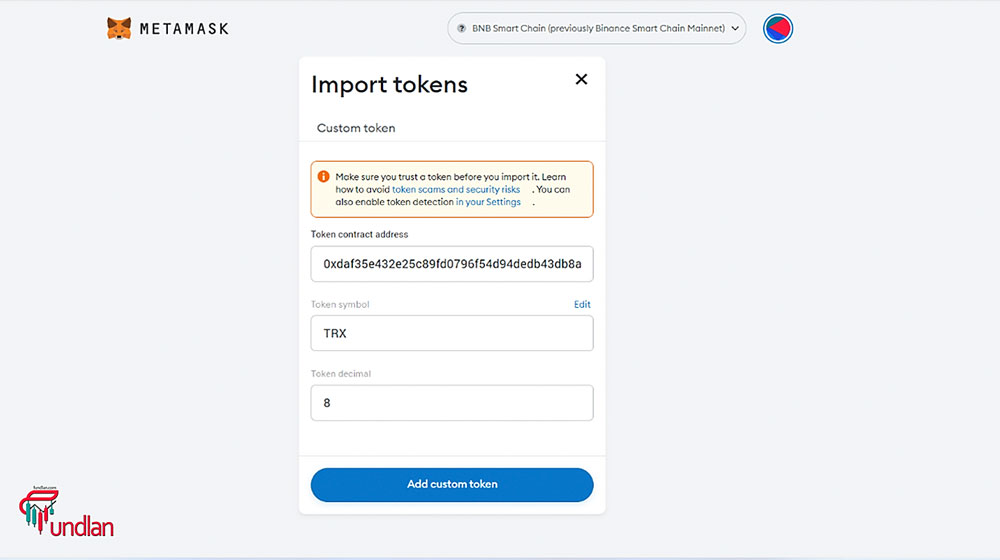

1. copy the Binance-Pegged TRX address. You can find it here.

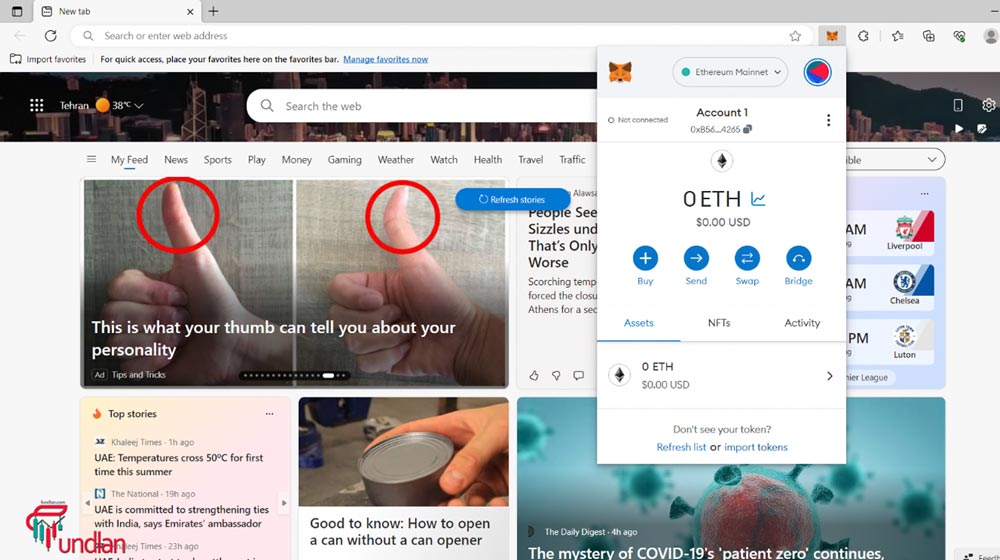

2. open up MetaMask and log in.

3. Make sure to choose the BSC network.

4. Click on import tokens.

5. Paste the contract address and fill in the blank. Then click on “add custom token.”

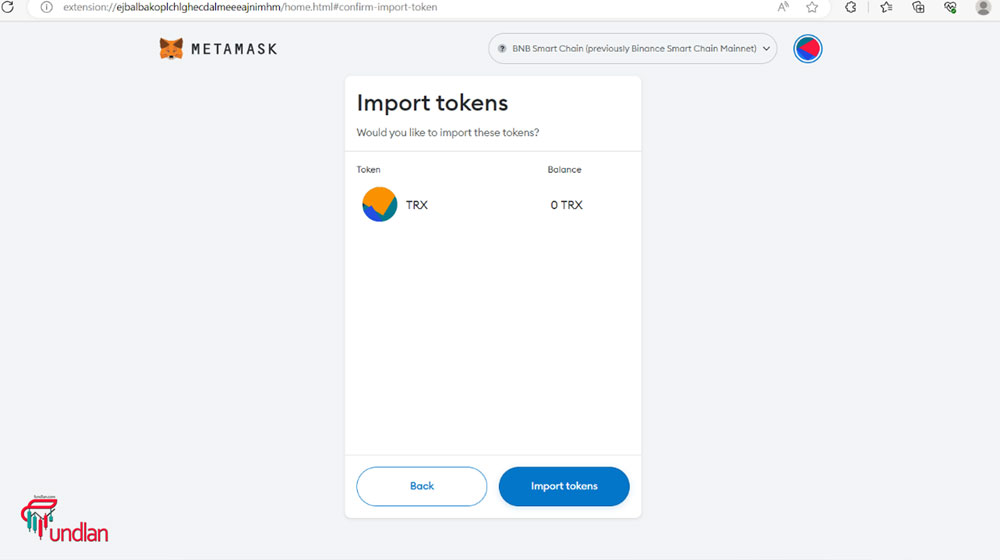

6. Lastly, click import tokens to TRC20 to MetaMask.

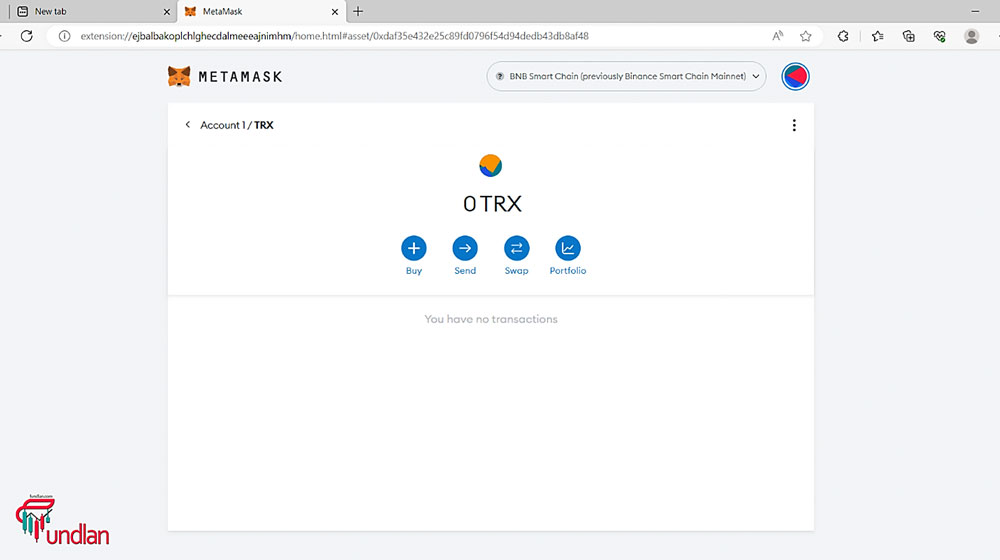

You have successfully added Tron Network (TRC20) to MetaMask on the Binance Smart chain.

Our special offer: free bitcoin mining sites without investment

Conclusion

At the moment, it is impossible to add the TRC20 MetaMask to your digital wallet; Because Tron is not compatible with the EVM blockchain and MetaMask can only work with Ethereum Virtual Machine compatible blockchains.

However, you can add the Binance-Pegged TRX version to MetaMask via the Binance Smart chain network by manually entering the correct contract address of the token in the wallet.

Alternatively, you can use a completely different wallet with native Tron network support. One of these wallets is the Tron wallet, which is available as a browser extension and mobile application for Android and iOS.