You might have heard about the trade NFTs terms if you are into cryptocurrencies. NFTs are one of the most essential phenomena in cryptocurrency in 2021. Why?

Because NFTs are way more valuable than other digital tokens as non-fungible ones. NFTs continue to grow in popularity in cryptocurrency, and it makes sense to consider ways to interact with them.

One of the ways to interact with NFTs is through a MetaMask NFT connection. In short, MetaMask is a crypto wallet that can help manage the NFT bubble.

So be clear; we will show you how to trade NFTs using MetaMask in this article. Stay relaxed and follow me.

Trading NFTs by MetaMask

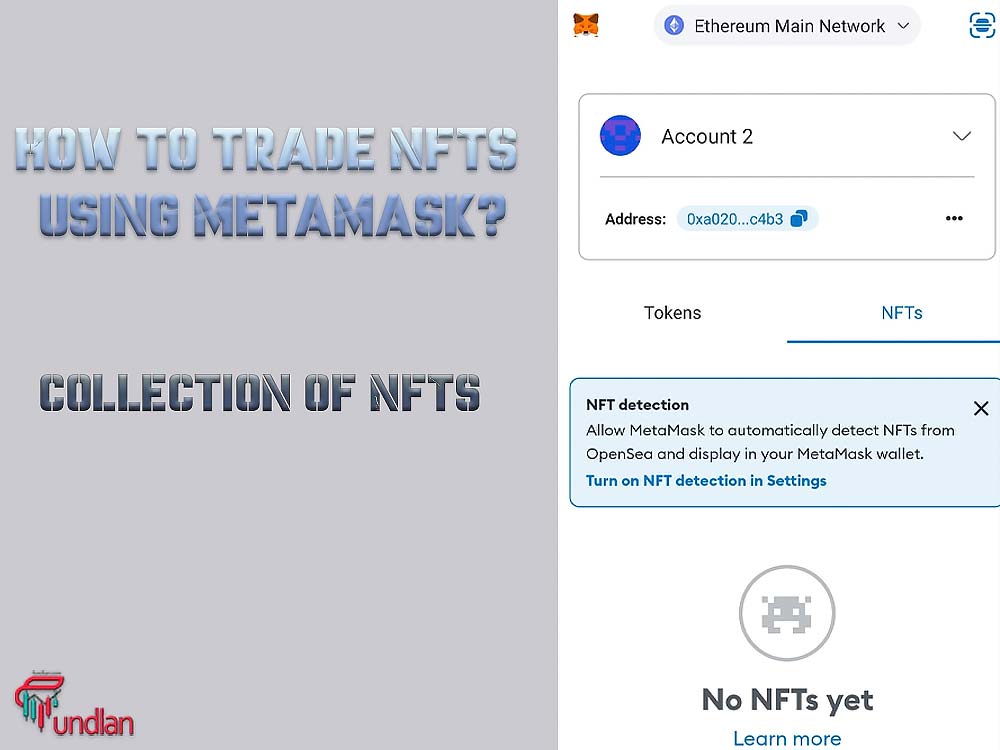

When considering NFTs and MetaMask, one of the biggest questions that pop into people’s minds is, “Can I store NFTs on MetaMask?” how to see NFT in Metamask?

You can add NFTs as custom tokens to the MetaMask browser extension. MetaMask is currently working on better NFT support for the MetaMask browser extension. You also store your NFTs in MetaMask mobile.

In this way, you can see your NFTs in the Collectibles tab of the MetaMask mobile app. The app helps you find listings for NFTs you own and gain insight into NFT pricing and market trends.

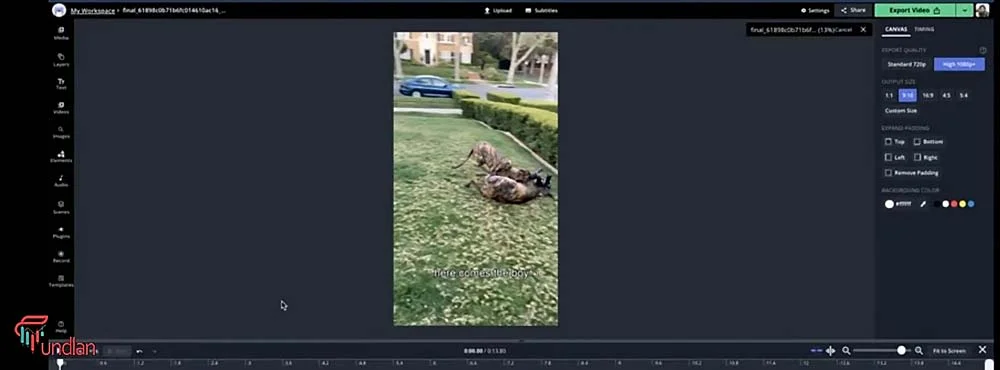

To trade NFTs with MetaMask, you must learn how to send them properly.

You can follow the following steps to send NFTs through the mobile application of MetaMask:

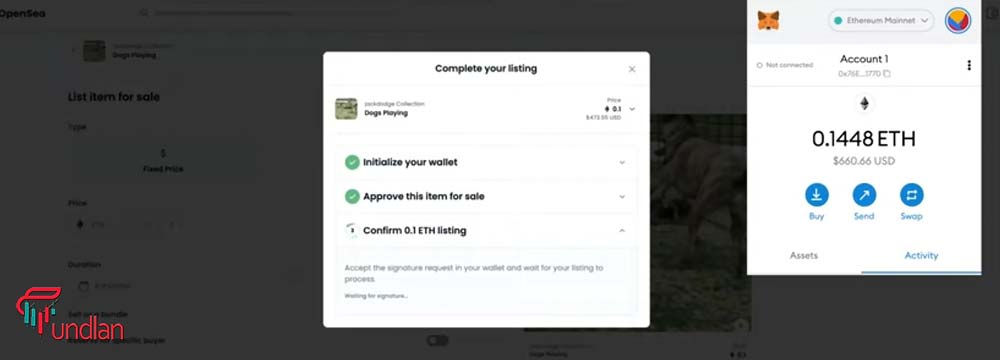

1-The first step in “selling NFTs on MetaMask,” or transferring ownership to another user, is to verify that you have enough gas to make the transaction. If you do not have enough gas for the transfer process, reverse transactions and gas loss will occur.

2-In the second step of submitting an NFT, click on the “NFT” tab in the MetaMask app.

3-The app will then redirect you to the collection of NFTs you own.

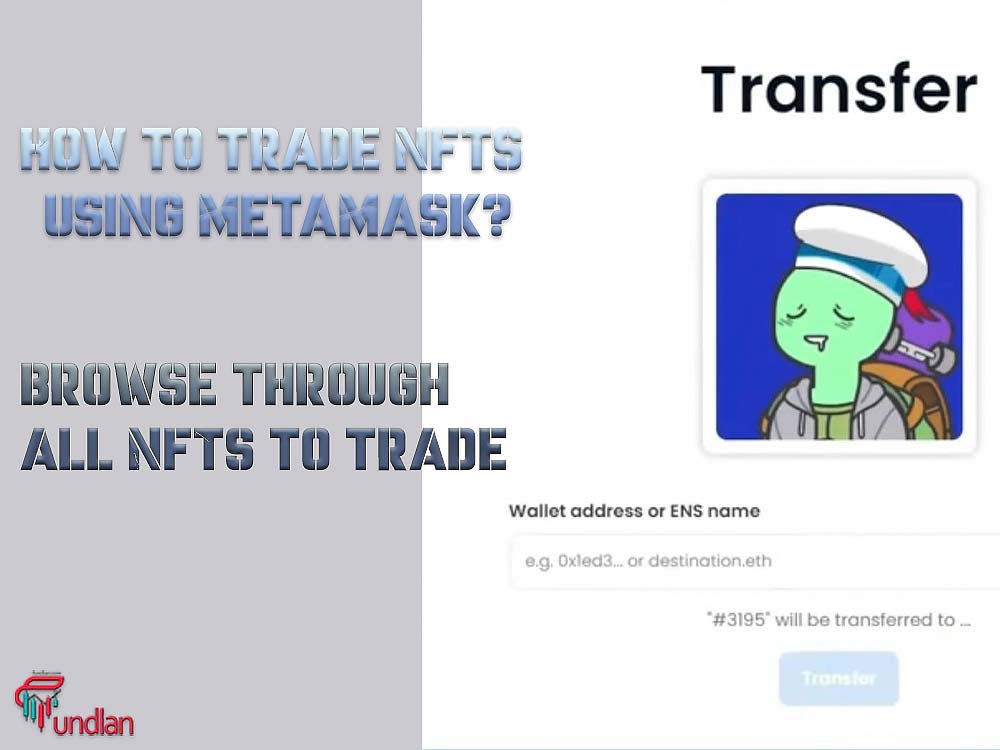

4-Browse through all NFTs and select the symbol of the NFT you want to transfer or sell.

5-Find the icon of the NFT you want to transfer to another wallet.

6-After clicking on the NFT of your choice, you will be taken to a new page. At the bottom of the new screen, you will find a “Submit” button. You agree to send the NFT to another user’s account by clicking the button.

7-After clicking the send button in MetaMask in the NFT transfer process, you will be in the final stage. In the last step, provide the address to which you want to send your NFTs and then comply with the standard transaction to complete the transfer.

Where to trade NFTs?

In addition to trading NFTs by trc20 MetaMask, you can trade your NFTs in different marketplaces.

Below are some of the best marketplaces to trade NFTs:

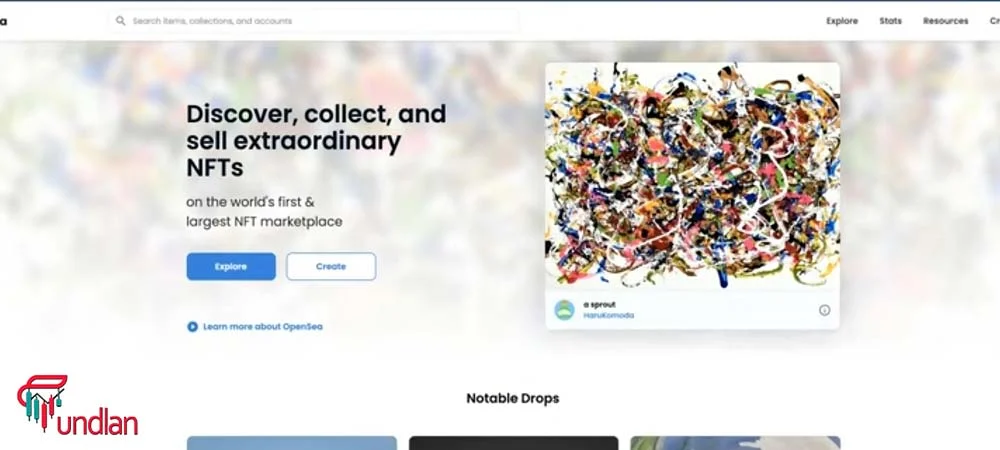

1. OpenSea

OpenSea, as a leader in NFT sales, has all sorts of digital assets on its platform. You can sign up in this marketplace for free and browse the extensive offerings.

The OpenSea marketplace covers more than 150 different payment tokens; thus, this marketplace is a great place to start for the NFT world.

2. Larva Labs

Larva Labs is best known for the viral NFT project CryptoPunks. They were originally given away for free in 2017, but some CryptoPunks have since sold for millions of dollars.

Larva Labs also operates other digital art projects such as Autoglyphs and other application development projects based on the Ethereum blockchain.

Larva Labs CryptoPunks NFTs are sold out, but can be bid on and purchased on various third-party marketplaces.

Still, Larva Labs’ various projects are worth watching, including Meebits, which can be bid on directly through the company’s built-in marketplace.

3. NBA Top Shot Marketplace

NBA Top Shot is the National Basketball Association and the Women’s Basketball Association’s move into the world of NFT ideas.

Collectible moments (video clips and game highlights) and artwork from the world’s best basketball leagues can be purchased on its marketplace.

The NBA uses the Flow blockchain developed by Dapper Labs to make it a closed marketplace (you can only buy and sell on Top Shot).

Signing up and buying directly from the Top Shot Marketplace website is easy. Collectible moments can be purchased for just a few dollars.

You can read to: Metamask vs Coinbase wallet for NFT

Final thoughts

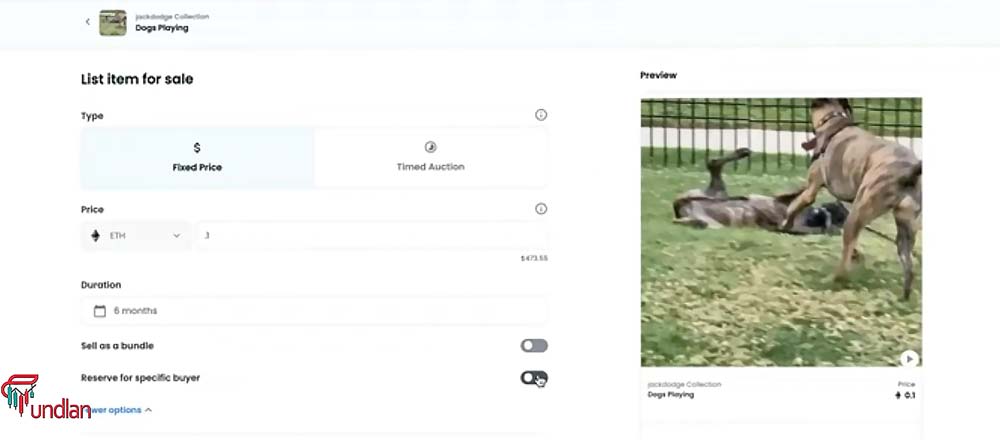

The MetaMask can provide you with a highly safe wallet to trade NFTs. You should know The NFT marketplace is how you invest in digital assets, collectibles, and art, but there are many options.

Be sure to choose one that suits your buying and storage needs based on the type of NFT you’re looking for and the cryptocurrency you plan to trade it in(NFT image size). Also, note that this is a new industry and highly speculative.

When making a purchase (if any), consider your overall investment strategy, net worth, and investment horizon. Please share your idea about trading NFTs using MetaMask in the comments.