How to mine bitcoin on phone? For the people who can’t involve the most recent NVIDIA GPU for mining or a top-end ASIC excavator, the capability of a Bitcoin mining application sounds great by and by, yet could you at any point mine Bitcoin utilizing your telephone?

Free digital money mining and free Bitcoin mining rehearses are particularly well known with the majority, with many organizations presently sending off applications to oblige the developing necessities of the crypto excavators.

How to mine bitcoin on phone

How to mine bitcoin on phone

How to mine bitcoin on phone for free

How to mine bitcoin on phone? How long does it take to mine 1 Bitcoin? Asserted Bitcoin digging applications in all actuality do exist for your telephone, and crypto excavators can download these applications. Nonetheless, there are a few significant provisos before you begin looking for app stores for this.

How to mine bitcoin on phone? Bitcoin, most importantly, mining is serious work and requires a long period of consistent computational/electrical stockpile to mine Bitcoin, which is difficult to do through a straightforward telephone application.

This is because most telephones are somewhat frail, contrasted with the power that GPUs, ASICs, or GUIs gloat. Given the high Bitcoin mining trouble, it is practically unimportant to mine with one telephone.

Other than that, one more detriment related to mining Bitcoin through mobiles is its interior arrangement doesn’t uphold mining Bitcoins.

How to mine bitcoin on apple phone

How to mine bitcoin on phone? Have you at any point needed to mine Bitcoin with your iPhone? Assuming you do, you likely have heard that it’s not the most intelligent choice you can make since the amount of Bitcoin you can mine relies upon the computational power of your iPhone, and even if you have the most recent one, you will get some Satoshi, presumably, your battery duration will diminish dramatically and in the end will kill your iPhone.

How to mine bitcoin on apple phone

However, consider the possibility that I let you know there’s one more method for mining cryptos that won’t kill your iPhone’s battery. Furthermore, in particular, you can do anything you desire with this digital currency: you can exchange with, sell it, keep it, stake it, or change it for another crypto… like Bitcoin.

I know the vast majority of you will adore this task since it includes the Internet of Things [IoTs]. Essentially, the Internet of Things permits generally brilliant gadgets to speak with one another, disperse various kinds of data, temperature, following bundles, and so on.

This application has validators and hubs, and by downloading the application you become a hub. There are significant organizations supporting Nodle like Cisco, Meraki, ESTV, Ledger, Polkadot, Tangem, and Republic.

The manner in which it works it’s absolutely private, it checks information bundles and rewards you by relying upon the association and parcel signal you identify with your portable close to you. At the point when you download the application, it associates safely and secretly with various gadgets. You need to turn on your Bluetooth and you will get remunerates gradually, contingent upon the communication with your telephone.

Allow me to show you my prizes, up until this point.

Nodle Cash (NODL) is the local badge of the Nodle Network, with a most extreme stockpile of 21 billion. It is a utility and administration token conveyed like clockwork to the Nodle Network members.

NODL is the Nodle Network’s utility token. It makes an impetus for members to come and develop the organization. The Nodle Chain has an underlying administration framework wherein all NODL holders have a voice. Also, to wrap things up, help curate the rundown of collators on the Nodle Chain by marking your NODL.

You can adapt your versatile application with the Nodle SDK

SDK to make a portable application coordinating Nodle in the application as opposed to charging the client through promotions and information burglary. This is in the back-end mining, coordinate it into your application, and adapt the application without the need to sell client information or show irritating advertisements.

How to mine bitcoin on an apple phone

How to mine bitcoin on an apple phone

Utilize the Nodle SDK in the event that you’re fostering a computer game or an application and what it to be totally free without selling your clients’ information or attacking them with irritating promotions.

Some way or another you’re making the web free, rather than offering data to outsiders, since you’re taking part in the organization, you’re paying for that utilization of the Internet. The geolocation works like Apple Airtags: through other Apple, gadgets can find those AirTags.

The Architecture

The Nodle network is made out of various components collaborating together all together o associate IoT gadgets to the cloud while producing NODL awards for each member simultaneously.

The association is truly straightforward: Subscribers request data from the Validators and pay to them with the Nodle token, then the validator gets the data from the hubs by paying additionally with the Nodle token, and the Network donors gather the data required from IoT gadgets and send it to the Validators which at last gives to the Subscribers.

How to mine bitcoin on phone for free

How to mine bitcoin on phone for free

How to start bitcoin mining at home for free on pc and phone?

How to mine bitcoin on android for free?

How to mine bitcoin on phone? The following is the rundown of the most developed and strong cell phones for mining bitcoin.

ROG Phone 5 from Asus

How to mine bitcoin on phone? The Asus ROG Phone 5 is perhaps the most capable cell phone to mine bitcoin; the Qualcomm Snapdragon 888 chipset works the contraption. The cell phone’s 5 nm-based processor has amazing handling power and can direct well in the registering system expected to mine the cryptographic money.

The cell phone likewise has a major 6,000mAh battery, pursuing it an ideal decision for digital currency mining on the grounds that a decrease in battery limit won’t essentially impact everyday utilization.

System S21 Ultra (Samsung)

The Samsung S21 Ultra was recently delivered and has since turned into all the rage. The device is driven by a staggeringly strong Exynos 2100 chipset in India, based on a 5 nm creation process, and gives elite execution and dependability.

The cell phone likewise incorporates up to 16GB of RAM and UFS 3.1 capacity. Thus, the cell phone is more than fit for executing many assignments, such as digging refined calculations for Crypto installments.

The OnePlus 8T

The OnePlus 8T telephone is more seasoned than the beyond two in this positioning. However, it begins with an exceptionally impressive equipment plan that appears more than reasonable for most errands.

The Qualcomm Snapdragon 865 chipset, fabricated on a 7 nm innovation, abilities the cell phone. The contraption likewise has up to 12 GB of RAM and inside stockpiling in light of UFS 3.1. This blend supplements the framework improvement on OnePlus cell phones to give a more liquid encounter.

How long does to mine 1 bitcoin on phone?

How to mine bitcoin on phone? Bitcoin is a kind of computerized cash that utilizes cryptography strategies to control the creation and move of cash.

Bitcoin is independent, and that implies any power or bank substance doesn’t oversee it. Bitcoin might be used to purchase items and products on the web or traded for different monetary standards on bitcoin markets.

How long does to mine one bitcoin on the phone?

How long does to mine one bitcoin on the phone?

How to mine Bitcoin on phone? Bitcoin might be procured in two or three procedures. One choice is to utilize your Android cell phone to mine Bitcoin. Mining Bitcoin on an Android gadget is a cycle that demands investment and tolerance. Be that as it may, if you are successful in mining Bitcoin, you will create a critical gain.

You can mine 0.00001983 in 48 hours. You can calculate how long it will take to mine 1 bitcoin based on that.

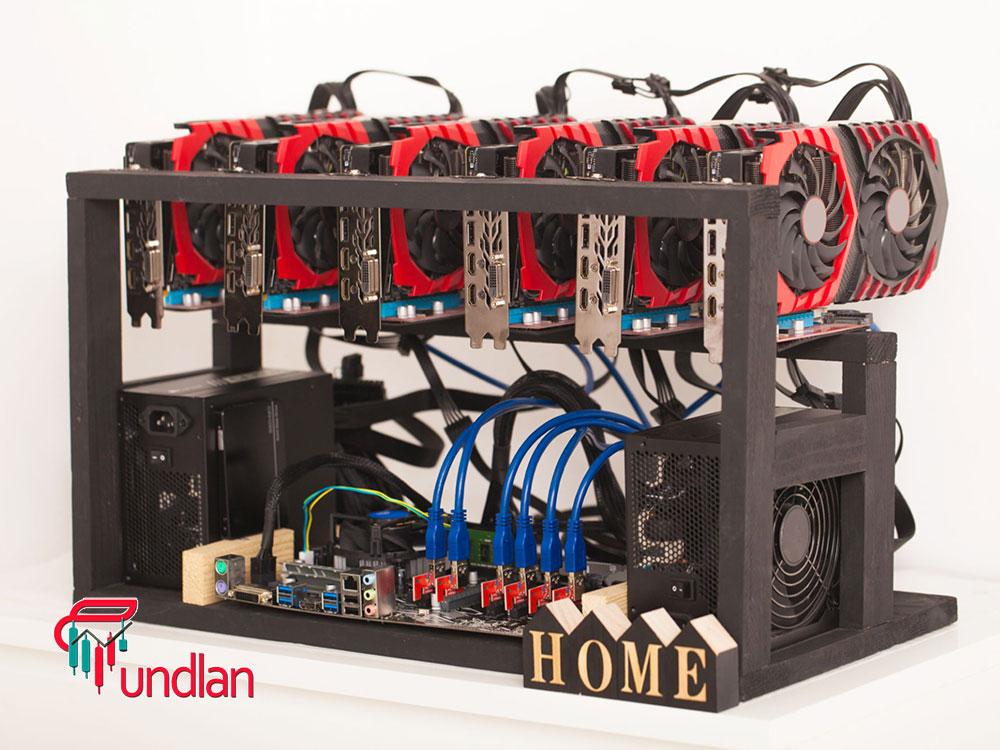

The main Bitcoin mining equipment

The main Bitcoin mining equipment Bitcoin mining pc specs calculator

Bitcoin mining pc specs calculator Crypto mining CPU requirements

Crypto mining CPU requirements Bitcoin mining pc requirements

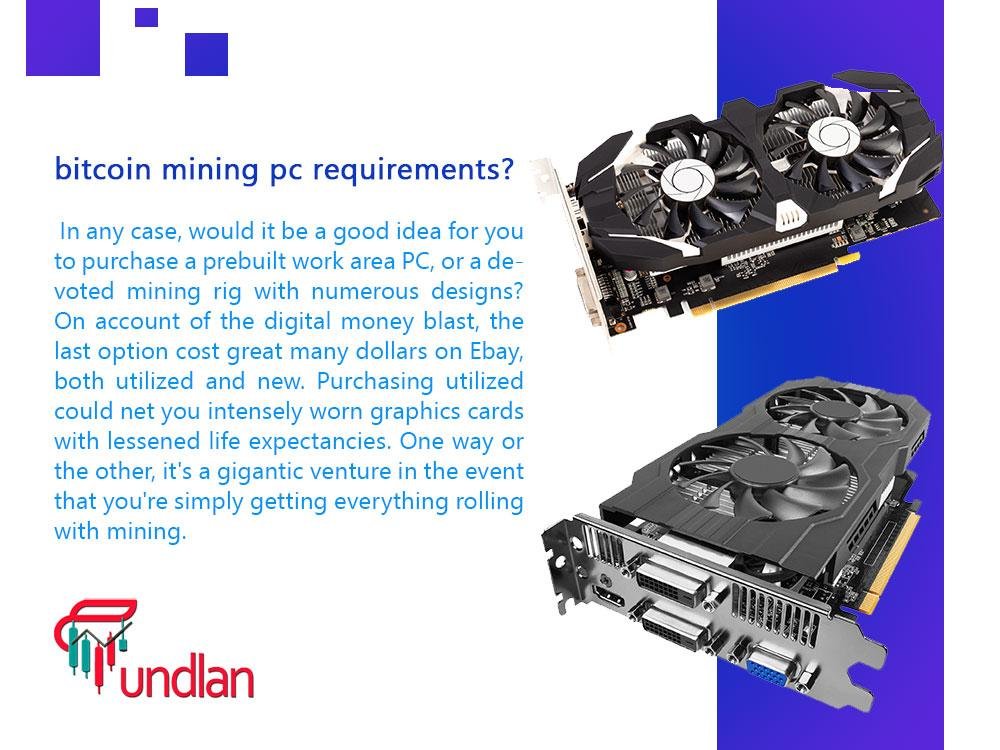

Bitcoin mining pc requirements bitcoin mining pc requirements?

bitcoin mining pc requirements?

Proof of work algorithms

Proof of work algorithms